This post is for someone who is wondering:

This post is for someone who is wondering:

- Whether they have the proper asset allocation

- Whether they should sell equities and buy bonds

- How to reduce investment stress while still benefitting from returns

- How to quantify their risk tolerance

- How to continue moving forward on their path to financial freedom despite all the uncertainty

One of my primary goals on Financial Samurai is to help readers build meaningful wealth in a risk-appropriate manner. Because I started my career soon after the 1997 Asian Financial Crisis, I’ve experienced a lot of carnage as many international college students in the US had to drop out due to a sudden and massive devaluation of their respective home country’s currencies. I fully appreciate how hazardous the road to building great wealth can be.

Even the best-made plans can be laid to waste due to some unforeseen exogenous variable. We always hope for good surprises along the way. Unfortunately, life always has a way of kicking us in the face after knocking us in the teeth. Let’s always be thankful for what we have and demonstrate kindness to those who are experiencing difficult times.

Most investors overestimate their risk tolerance, especially investors who’ve only been investing with significant capital since 2009. Once the losses start piling up, it’s not only the melancholy of losing money that starts getting to you, it’s the growing fear that your job might also be at risk.

You might also erroneously think that the richer you get, the higher your risk tolerance. After all, the more money you have, the bigger your buffer. This is a fallacy because the more money you have, the larger your potential loss. For most rational people, their lifestyles don’t inflate commensurately with their wealth. This is why even rich people can’t resist a free rubber chicken lunch.

Further, there will come a time when your investment returns have a larger impact on your net worth than your earnings. As a result, the richer you are, the more dismayed you will be to lose money. Your main hope for recovery is a rebound in investment performance because your work earnings won’t contribute much at all.

How Most Of Us Rescue Our Investments

The reason we all continue to fight in this difficult world is because we have hope. But eventually, our hope fades because our brains and bodies slow down. When we’re younger, we often think ourselves to be invincible. Then, eventually, we start experiencing the realities of aging.

It is due to our fading abilities that we must bring down our risk exposure as we age. It is only the rare bird that goes all-in after making enough money to last a lifetime to try and make so much more. Sometimes they turn into billionaires like Elon Musk. But most of the time they end up going broke and filled with regret.

The only way most of us can rescue our investments after a market swoon is through contributions from earned income i.e. our salaries. We tell ourselves that when the markets are down, that’s alright because we’ll simply invest more at lower prices.

However, lower prices don’t necessarily mean better value if estimates are cut, but all other things being equal, we like to trick ourselves into believing we’re getting a better deal all the same.

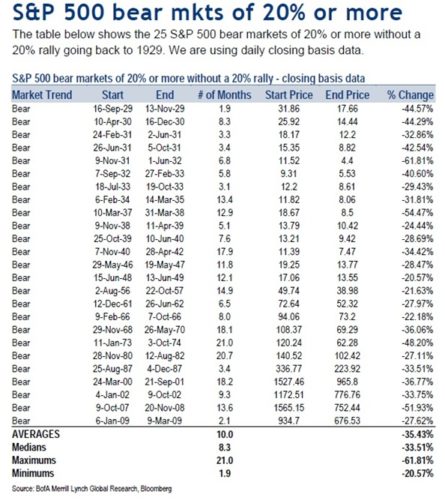

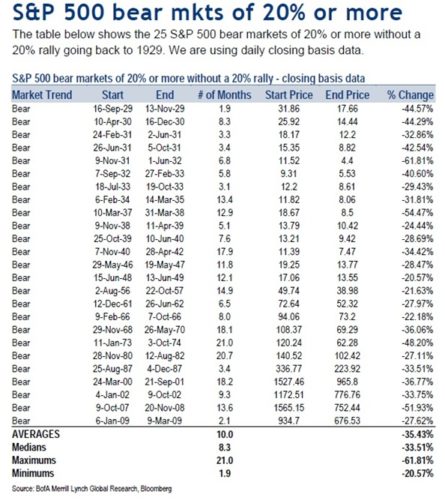

To understand reward, we must first understand risk. Since 1929, the median bear market price decline is 33.51%, while the average bear market price decline is 35.43% since 1929.

Therefore, it’s reasonable to assume that the next bear market could also bring equity valuations down by 35% over an 8 – 10 month period.

Let me share a quantifiable way to measure how much equity exposure you should have based on your risk tolerance.

I’m calling it the Financial Samurai Equity Exposure Rule or Financial SEER. It’s an appropriate acronym because seer means a person who is supposed to be able, through supernatural insight, to see what the future holds.

How To Quantify Your Risk Tolerance

Most people just regularly invest in stocks over time through dollar cost averaging. They have little concept of whether the amount of stocks they have as part of their portfolio or their net worth is risk appropriate.

Hence, to quantify your risk tolerance based on your existing portfolio, use the following formula:

(Public Equity Exposure X 35%) / Monthly Gross Income.

For example, let’s say you have $500,000 in equities and make $10,000 a month. To quantify your risk tolerance, the formula is: $500,000 X 35% = $175,000 / $10,000 = 17.5.

This formula tells you that you will need to work an 17.5 ADDITIONAL months of your life to earn a GROSS income equal to how much you lost in a -35% bear market. After taxes, you’re really only making around $8,000 a month, so you will actually have to work closer to 22 more months and contribute 100% of your after-tax income to be whole.

But it gets worse. Given you need to pay for basic living expenses, you need to work even longer than 22 months. Good thing stocks tend to rebound after an average bear market duration of 10 months, if you can hold on.

Given everybody has a different tax rate, I’ve simplified the formula using a gross monthly income figure instead of a net monthly income figure. Feel free to adjust the Risk Tolerance Multiple based on your personal income tax situation.

Quantifying risk tolerance by calculating working months is the best way to go because time is money. The more you value your time, the more you hate your job, and the less you desire to work, the lower your risk tolerance.

The classic scenario is a 68-year-old retiree with a $1,000,000 portfolio living off $20,000 a year in Social Security and $20,000 in dividend income from his portfolio.

If his portfolio loses 30% of its value because it is way overweight equities, it is almost impossible to recover the lost $300,000 on his $20,000 a year fixed income. His dividend income may likely be cut as well as companies hold onto their cash for survival. The only thing this retiree can do is pray the market eventually goes up while cutting spending.

How To Determine Appropriate Equity Exposure

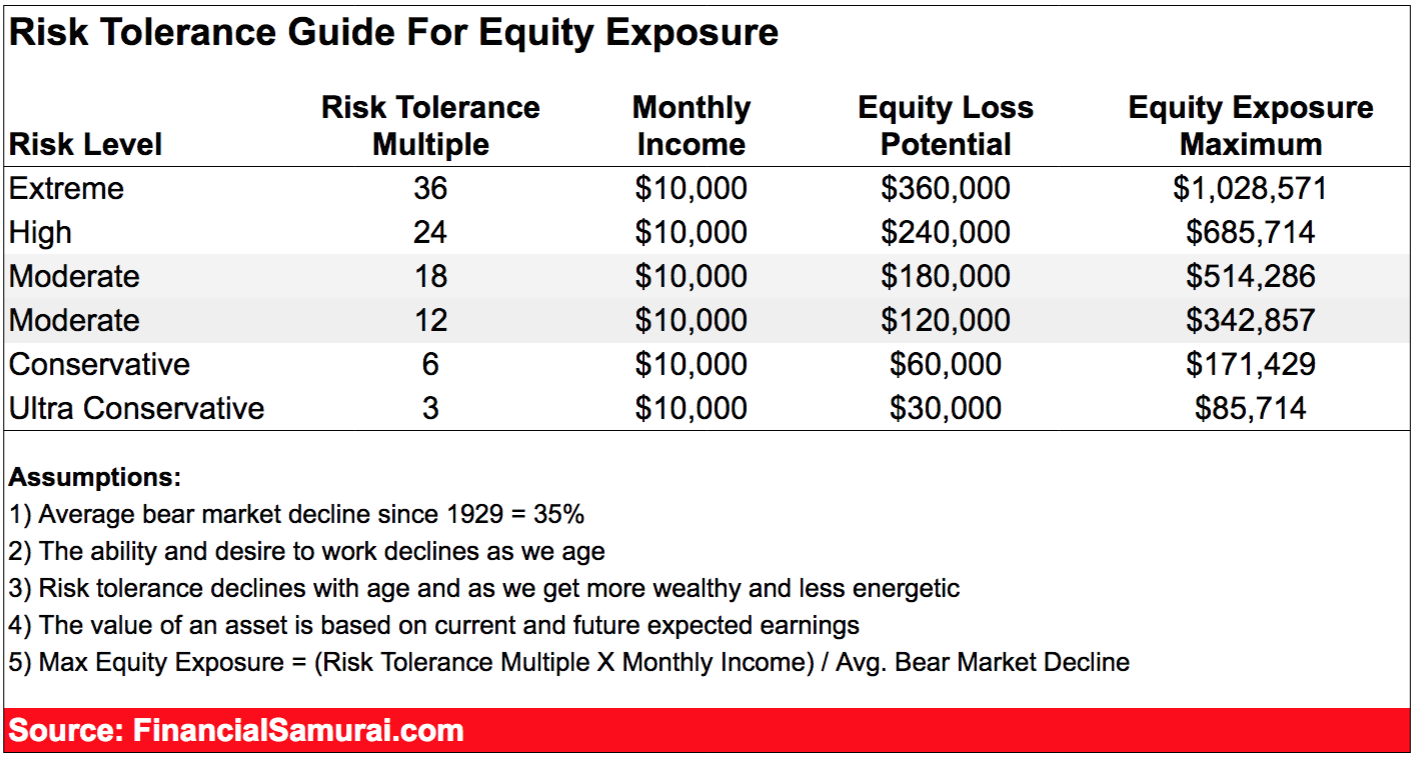

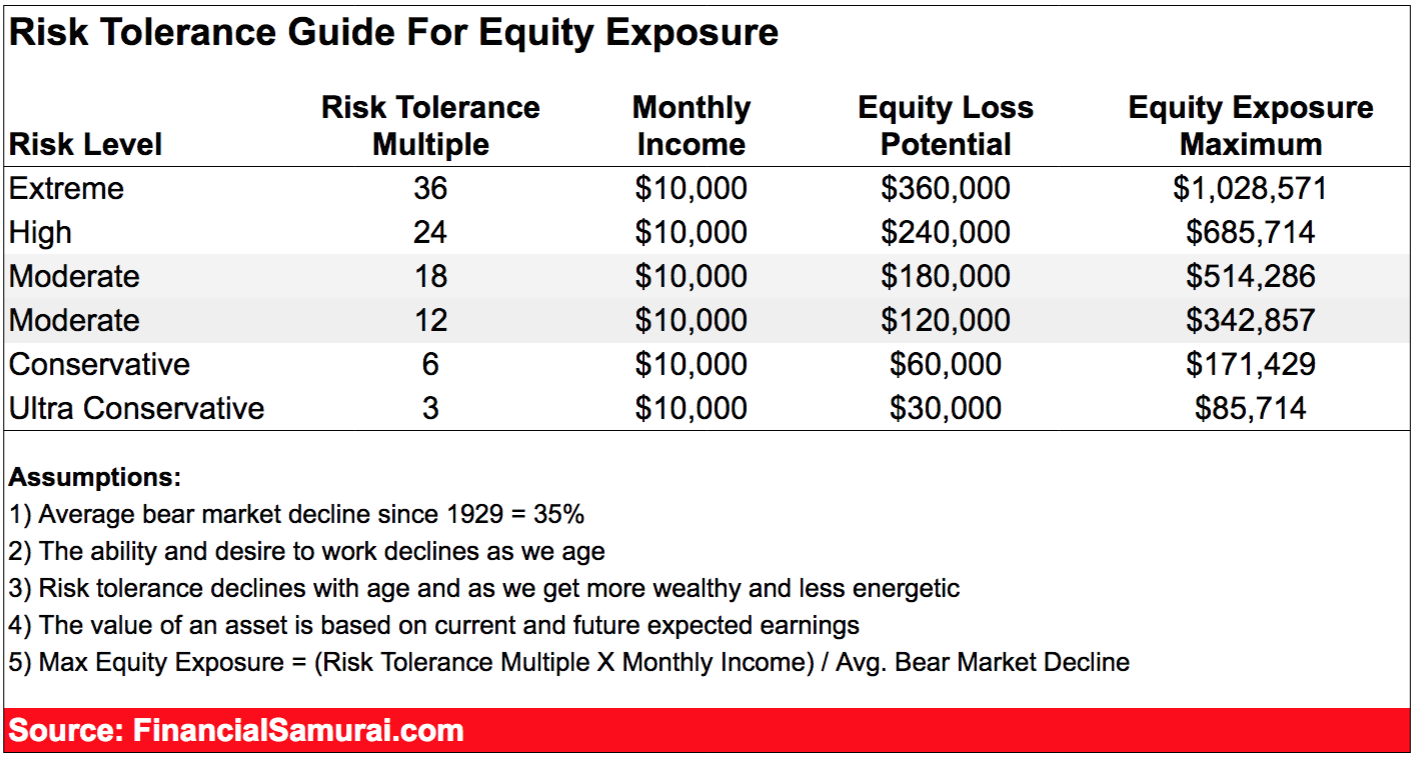

After you have quantified your risk tolerance by assigning a Risk Tolerance Multiple = the number of months you need to work to make up for your potential bear market loss, take a look at this guide below.

My guide will not only give you an idea of what your Risk Tolerance Multiple is, but it will also give you an idea of what your maximum equity exposure should be based on your risk tolerance. Solutions!

My advice to all investors is to not risk more than 18 months worth of gross salary on your equity investments using an assumed 35% average bear market decline in your public investment portfolio.

In other words, if you make $10,000 a month, the most you should risk is a $180,000 loss on a $514,285 pure equity portfolio.

The Max Equity Exposure formula = (Your Monthly Salary X 18) / 35%.

You can certainly have a larger overall public investment portfolio than $514,285 in this example, but I wouldn’t risk much more than $514,285 in equities only if you have only a $10,000 a month gross salary.

You can have $514,285 max in equities plus $250,000 in AAA-rated municipal bonds if you wish, for a reasonable 67%/33% equities fixed income split. Your total portfolio size would therefore be $764,285.

Adjust The Assumptions As You See Fit

If you think the next bear market will only decline by 25%, feel free to use 25% in the Max Equity Exposure formula. In the above example, the result would be ($10,000 X 18) / 25% = $720,000 of maximum equity exposure for someone making $120,000 a year.

If you just got promoted and plan to see 20% YoY earnings growth for the next five years, you could use your current monthly salary and a higher Risk Tolerance Multiple to determine your equity exposure. For example, let’s say you currently make $10,000 a month, but expect to make $20,000 a month in five years, You also think stocks will go down by 25% at most. The calculation would therefore be: ($10,000 X 36) / 25% = $1,440,000 as your target or maximum equity exposure.

If you decide to live like a hermit in a low cost town in the middle of nowhere, you could increase your Risk Tolerance Multiple to 36. But you’ve got to question your money priorities for trying to make a bigger return only to never spend your rewards.

Remember, whatever your Risk Tolerance Multiple is, you will have to increase it by 1.2 – 3X to truly calculate how many more years you will need to work to recover from your bear market losses due to taxes and general living expenses.

It is a judgment call regarding how much equity risk you should take. If you’ve quadrupled your net worth after a 9-year bull market, it’s probably wise to lower your risk exposure multiple. Conversely, after a 30%+ correction in equities, it’s probably wise to increase your risk exposure multiple.

The closer you get to retirement, the lower your multiple should be as well. Nobody wants to get close to the financially free finish line only to break a leg and get carted off in an ambulance.

Be A Rational Investor With Financial SEER

The valuation of everything is dependent on current and future earnings. It takes time and energy to create those earnings from your job or your business. If you are seriously burning out, please dial down risk and give yourself some time to heal.

For the average person in a normal economic cycle, a gross Risk Tolerance Multiple of 18 is my recommendation. Most people have the fortitude to waste up to around 2-3 years of their lives to gain back what they’ve lost from a bear market. But after three years of digging out of a hole, things start to feel hopeless as the average person starts giving up.

Remember, things could always be worse! Not only could your stock investments lose more than 35%, you could lose all your home equity due to leverage, your business, your job, and your spouse as well. Please invest rationally and responsibly.

I hope the Financial Samurai Equity Exposure Rule (SEER) helps you take the subjective term of risk tolerance and shapes it into something quantifiable. You now have a concrete way of determining your equity exposure and risk tolerance.

Financial SEER formulas:

Risk Tolerance = (Public Equity Exposure X Expected Percentage Decline) / Monthly Gross Income

Maximum Equity Exposure = (Your Monthly Salary X Risk Tolerance Multiple) / Expected Percentage Decline

Related Posts:

Recommended Net Worth Allocation By Age Or Work Experience

The Proper Asset Allocation Of Stocks And Bonds By Age

Readers, how do you quantify risk tolerance? How many months are you willing to work to make up for potential losses in your portfolio? Is your equity exposure appropriate for your risk tolerance? What is your Risk Tolerance Multiple?

The post Financial SEER: A Way To Quantify Risk Tolerance And Determine Appropriate Equity Exposure appeared first on Financial Samurai.

We’re back with another rookie mistake and this is a good one if you want to get organized this year. Come learn the RIGHT way to organize your stuff…

We’re back with another rookie mistake and this is a good one if you want to get organized this year. Come learn the RIGHT way to organize your stuff… This post is for someone who is wondering:

This post is for someone who is wondering: